10 minutes

Smart contract development: Emprunter 1 million de DAI (~dollars) avec un flashloan sur DyDx

Dans cet article nous allons voir comment réaliser un Flashloan sur DyDx.

Nous allons emprunter $1 000 000 et le rembourser instantanément avec des frais seulement de 2 wei. Crazy !

Pour cet example, j’ai utilisé Node version:

nvm use v14.17.6. J’ai aussi installé les modules NodeJSganache-cliettruffle

Création du Smart contract

Créer un fichier SimpleDyDxFlashloan.sol dans le répertoire contracts/simple-dydx-flashloan de votre repo git et ajouter le contenu suivant:

// SPDX-License-Identifier: MIT

pragma solidity ^0.8.0;

pragma experimental ABIEncoderV2;

import "@openzeppelin/contracts/token/ERC20/IERC20.sol";

import "./interfaces/DyDxFlashloanBase.sol";

import "./interfaces/ICallee.sol";

contract SimpleDyDxFlashloan is DydxFlashloanBase, ICallee {

address private constant SOLO = 0x1E0447b19BB6EcFdAe1e4AE1694b0C3659614e4e;

address public user;

event Log(string message, uint256 val);

struct Data {

address token;

uint256 repayAmount;

}

// Call dydx and request a flashloan

function initiateFlashloan(address _token, uint256 _amount) external {

ISoloMargin solo = ISoloMargin(SOLO);

uint256 marketID = _getMarketIdFromTokenAddress(SOLO, _token);

// Calculate repay amount

uint256 repay_amount = _getRepaymentAmountInternal(_amount);

IERC20(_token).approve(SOLO, repay_amount);

Actions.ActionArgs[] memory operations = new Actions.ActionArgs[](3);

operations[0] = _getWithdrawAction(marketID, _amount);

operations[1] = _getCallAction(

abi.encode(Data({token: _token, repayAmount: repay_amount}))

);

operations[2] = _getDepositAction(marketID, repay_amount);

Account.Info[] memory accountInfos = new Account.Info[](1);

accountInfos[0] = _getAccountInfo();

solo.operate(accountInfos, operations);

}

// This function receives the flashloan

// Fallback function called by dydx

function callFunction(

address sender,

Account.Info memory account,

bytes memory data

) public override {

require(

msg.sender == SOLO,

"the caller to this function is not SOLO contract"

);

require(

sender == address(this),

"sender of the flashloan has to be the address of dydxFlashloan"

);

Data memory data_decoded = abi.decode(data, (Data));

uint256 repay_amount = data_decoded.repayAmount;

uint256 balance = IERC20(data_decoded.token).balanceOf(address(this));

require(

balance >= repay_amount,

"balance has to be higher than repay amount"

);

user = sender;

emit Log("balance", balance);

emit Log("repay amount", repay_amount);

emit Log("balance - repay amount", balance - repay_amount);

}

}

L’interface DyDxFlashloanBase.sol dans le répertoire ./contracts/simple-dydx-flashloan/interfaces ressemble à ceci:

// SPDX-License-Identifier: GPL-3.0-or-later

pragma solidity ^0.8;

pragma experimental ABIEncoderV2;

import "@openzeppelin/contracts/utils/math/SafeMath.sol";

import "@openzeppelin/contracts/token/ERC20/IERC20.sol";

import "./ISoloMargin.sol";

contract DydxFlashloanBase {

using SafeMath for uint256;

// -- Internal Helper functions -- //

function _getMarketIdFromTokenAddress(address _solo, address token)

internal

view

returns (uint256)

{

ISoloMargin solo = ISoloMargin(_solo);

uint256 numMarkets = solo.getNumMarkets();

address curToken;

for (uint256 i = 0; i < numMarkets; i++) {

curToken = solo.getMarketTokenAddress(i);

if (curToken == token) {

return i;

}

}

revert("No marketId found for provided token");

}

function _getRepaymentAmountInternal(uint256 amount)

internal

pure

returns (uint256)

{

// Needs to be overcollateralize

// Needs to provide +2 wei to be safe

return amount.add(2);

}

function _getAccountInfo() internal view returns (Account.Info memory) {

return Account.Info({owner: address(this), number: 1});

}

function _getWithdrawAction(uint256 marketId, uint256 amount)

internal

view

returns (Actions.ActionArgs memory)

{

return

Actions.ActionArgs({

actionType: Actions.ActionType.Withdraw,

accountId: 0,

amount: Types.AssetAmount({

sign: false,

denomination: Types.AssetDenomination.Wei,

ref: Types.AssetReference.Delta,

value: amount

}),

primaryMarketId: marketId,

secondaryMarketId: 0,

otherAddress: address(this),

otherAccountId: 0,

data: ""

});

}

function _getCallAction(bytes memory data)

internal

view

returns (Actions.ActionArgs memory)

{

return

Actions.ActionArgs({

actionType: Actions.ActionType.Call,

accountId: 0,

amount: Types.AssetAmount({

sign: false,

denomination: Types.AssetDenomination.Wei,

ref: Types.AssetReference.Delta,

value: 0

}),

primaryMarketId: 0,

secondaryMarketId: 0,

otherAddress: address(this),

otherAccountId: 0,

data: data

});

}

function _getDepositAction(uint256 marketId, uint256 amount)

internal

view

returns (Actions.ActionArgs memory)

{

return

Actions.ActionArgs({

actionType: Actions.ActionType.Deposit,

accountId: 0,

amount: Types.AssetAmount({

sign: true,

denomination: Types.AssetDenomination.Wei,

ref: Types.AssetReference.Delta,

value: amount

}),

primaryMarketId: marketId,

secondaryMarketId: 0,

otherAddress: address(this),

otherAccountId: 0,

data: ""

});

}

}

// test and deployment

La seconde interface ICallee.sol dans le répertoire ./contracts/simple-dydx-flashloan/interfaces contient le code suivant:

// SPDX-License-Identifier: GPL-3.0-or-later

pragma solidity ^0.8;

pragma experimental ABIEncoderV2;

import {Account} from "./ISoloMargin.sol";

/**

* @title ICallee

* @author dYdX

*

* Interface that Callees for Solo must implement in order to ingest data.

*/

interface ICallee {

// ============ Public Functions ============

/**

* Allows users to send this contract arbitrary data.

*

* @param sender The msg.sender to Solo

* @param accountInfo The account from which the data is being sent

* @param data Arbitrary data given by the sender

*/

function callFunction(

address sender,

Account.Info calldata accountInfo,

bytes calldata data

) external;

}

Enfin, la dernière interface ISoloMargin.sol dans le répertoire ./contracts/simple-dydx-flashloan/interfaces a le code suivant:

// SPDX-License-Identifier: GPL-3.0-or-later

pragma solidity ^0.8;

pragma experimental ABIEncoderV2;

library Account {

enum Status {

Normal,

Liquid,

Vapor

}

struct Info {

address owner; // The address that owns the account

uint256 number; // A nonce that allows a single address to control many accounts

}

struct accStorage {

mapping(uint256 => Types.Par) balances; // Mapping from marketId to principal

Status status;

}

}

library Actions {

enum ActionType {

Deposit, // supply tokens

Withdraw, // borrow tokens

Transfer, // transfer balance between accounts

Buy, // buy an amount of some token (publicly)

Sell, // sell an amount of some token (publicly)

Trade, // trade tokens against another account

Liquidate, // liquidate an undercollateralized or expiring account

Vaporize, // use excess tokens to zero-out a completely negative account

Call // send arbitrary data to an address

}

enum AccountLayout {

OnePrimary,

TwoPrimary,

PrimaryAndSecondary

}

enum MarketLayout {

ZeroMarkets,

OneMarket,

TwoMarkets

}

struct ActionArgs {

ActionType actionType;

uint256 accountId;

Types.AssetAmount amount;

uint256 primaryMarketId;

uint256 secondaryMarketId;

address otherAddress;

uint256 otherAccountId;

bytes data;

}

struct DepositArgs {

Types.AssetAmount amount;

Account.Info account;

uint256 market;

address from;

}

struct WithdrawArgs {

Types.AssetAmount amount;

Account.Info account;

uint256 market;

address to;

}

struct TransferArgs {

Types.AssetAmount amount;

Account.Info accountOne;

Account.Info accountTwo;

uint256 market;

}

struct BuyArgs {

Types.AssetAmount amount;

Account.Info account;

uint256 makerMarket;

uint256 takerMarket;

address exchangeWrapper;

bytes orderData;

}

struct SellArgs {

Types.AssetAmount amount;

Account.Info account;

uint256 takerMarket;

uint256 makerMarket;

address exchangeWrapper;

bytes orderData;

}

struct TradeArgs {

Types.AssetAmount amount;

Account.Info takerAccount;

Account.Info makerAccount;

uint256 inputMarket;

uint256 outputMarket;

address autoTrader;

bytes tradeData;

}

struct LiquidateArgs {

Types.AssetAmount amount;

Account.Info solidAccount;

Account.Info liquidAccount;

uint256 owedMarket;

uint256 heldMarket;

}

struct VaporizeArgs {

Types.AssetAmount amount;

Account.Info solidAccount;

Account.Info vaporAccount;

uint256 owedMarket;

uint256 heldMarket;

}

struct CallArgs {

Account.Info account;

address callee;

bytes data;

}

}

library Decimal {

struct D256 {

uint256 value;

}

}

library Interest {

struct Rate {

uint256 value;

}

struct Index {

uint96 borrow;

uint96 supply;

uint32 lastUpdate;

}

}

library Monetary {

struct Price {

uint256 value;

}

struct Value {

uint256 value;

}

}

library Storage {

// All information necessary for tracking a market

struct Market {

// Contract address of the associated ERC20 token

address token;

// Total aggregated supply and borrow amount of the entire market

Types.TotalPar totalPar;

// Interest index of the market

Interest.Index index;

// Contract address of the price oracle for this market

address priceOracle;

// Contract address of the interest setter for this market

address interestSetter;

// Multiplier on the marginRatio for this market

Decimal.D256 marginPremium;

// Multiplier on the liquidationSpread for this market

Decimal.D256 spreadPremium;

// Whether additional borrows are allowed for this market

bool isClosing;

}

// The global risk parameters that govern the health and security of the system

struct RiskParams {

// Required ratio of over-collateralization

Decimal.D256 marginRatio;

// Percentage penalty incurred by liquidated accounts

Decimal.D256 liquidationSpread;

// Percentage of the borrower's interest fee that gets passed to the suppliers

Decimal.D256 earningsRate;

// The minimum absolute borrow value of an account

// There must be sufficient incentivize to liquidate undercollateralized accounts

Monetary.Value minBorrowedValue;

}

// The maximum RiskParam values that can be set

struct RiskLimits {

uint64 marginRatioMax;

uint64 liquidationSpreadMax;

uint64 earningsRateMax;

uint64 marginPremiumMax;

uint64 spreadPremiumMax;

uint128 minBorrowedValueMax;

}

// The entire storage state of Solo

struct State {

// number of markets

uint256 numMarkets;

// marketId => Market

mapping(uint256 => Market) markets;

// owner => account number => Account

mapping(address => mapping(uint256 => Account.accStorage)) accounts;

// Addresses that can control other users accounts

mapping(address => mapping(address => bool)) operators;

// Addresses that can control all users accounts

mapping(address => bool) globalOperators;

// mutable risk parameters of the system

RiskParams riskParams;

// immutable risk limits of the system

RiskLimits riskLimits;

}

}

library Types {

enum AssetDenomination {

Wei, // the amount is denominated in wei

Par // the amount is denominated in par

}

enum AssetReference {

Delta, // the amount is given as a delta from the current value

Target // the amount is given as an exact number to end up at

}

struct AssetAmount {

bool sign; // true if positive

AssetDenomination denomination;

AssetReference ref;

uint256 value;

}

struct TotalPar {

uint128 borrow;

uint128 supply;

}

struct Par {

bool sign; // true if positive

uint128 value;

}

struct Wei {

bool sign; // true if positive

uint256 value;

}

}

interface ISoloMargin {

struct OperatorArg {

address operator;

bool trusted;

}

function ownerSetSpreadPremium(

uint256 marketId,

Decimal.D256 calldata spreadPremium

) external;

function getIsGlobalOperator(address operator) external view returns (bool);

function getMarketTokenAddress(uint256 marketId)

external

view

returns (address);

function ownerSetInterestSetter(uint256 marketId, address interestSetter)

external;

function getAccountValues(Account.Info calldata account)

external

view

returns (Monetary.Value memory, Monetary.Value memory);

function getMarketPriceOracle(uint256 marketId)

external

view

returns (address);

function getMarketInterestSetter(uint256 marketId)

external

view

returns (address);

function getMarketSpreadPremium(uint256 marketId)

external

view

returns (Decimal.D256 memory);

function getNumMarkets() external view returns (uint256);

function ownerWithdrawUnsupportedTokens(address token, address recipient)

external

returns (uint256);

function ownerSetMinBorrowedValue(Monetary.Value calldata minBorrowedValue)

external;

function ownerSetLiquidationSpread(Decimal.D256 calldata spread) external;

function ownerSetEarningsRate(Decimal.D256 calldata earningsRate) external;

function getIsLocalOperator(address _owner, address operator)

external

view

returns (bool);

function getAccountPar(Account.Info calldata account, uint256 marketId)

external

view

returns (Types.Par memory);

function ownerSetMarginPremium(

uint256 marketId,

Decimal.D256 calldata marginPremium

) external;

function getMarginRatio() external view returns (Decimal.D256 memory);

function getMarketCurrentIndex(uint256 marketId)

external

view

returns (Interest.Index memory);

function getMarketIsClosing(uint256 marketId) external view returns (bool);

function getRiskParams() external view returns (Storage.RiskParams memory);

function getAccountBalances(Account.Info calldata account)

external

view

returns (

address[] memory,

Types.Par[] memory,

Types.Wei[] memory

);

function renounceOwnership() external;

function getMinBorrowedValue()

external

view

returns (Monetary.Value memory);

function setOperators(OperatorArg[] calldata args) external;

function getMarketPrice(uint256 marketId) external view returns (address);

function owner() external view returns (address);

function isOwner() external view returns (bool);

function ownerWithdrawExcessTokens(uint256 marketId, address recipient)

external

returns (uint256);

function ownerAddMarket(

address token,

address priceOracle,

address interestSetter,

Decimal.D256 calldata marginPremium,

Decimal.D256 calldata spreadPremium

) external;

function operate(

Account.Info[] calldata accounts,

Actions.ActionArgs[] calldata actions

) external;

function getMarketWithInfo(uint256 marketId)

external

view

returns (

Storage.Market memory,

Interest.Index memory,

Monetary.Price memory,

Interest.Rate memory

);

function ownerSetMarginRatio(Decimal.D256 calldata ratio) external;

function getLiquidationSpread() external view returns (Decimal.D256 memory);

function getAccountWei(Account.Info calldata account, uint256 marketId)

external

view

returns (Types.Wei memory);

function getMarketTotalPar(uint256 marketId)

external

view

returns (Types.TotalPar memory);

function getLiquidationSpreadForPair(

uint256 heldMarketId,

uint256 owedMarketId

) external view returns (Decimal.D256 memory);

function getNumExcessTokens(uint256 marketId)

external

view

returns (Types.Wei memory);

function getMarketCachedIndex(uint256 marketId)

external

view

returns (Interest.Index memory);

function getAccountStatus(Account.Info calldata account)

external

view

returns (uint8);

function getEarningsRate() external view returns (Decimal.D256 memory);

function ownerSetPriceOracle(uint256 marketId, address priceOracle)

external;

function getRiskLimits() external view returns (Storage.RiskLimits memory);

function getMarket(uint256 marketId)

external

view

returns (Storage.Market memory);

function ownerSetIsClosing(uint256 marketId, bool isClosing) external;

function ownerSetGlobalOperator(address operator, bool approved) external;

function transferOwnership(address newOwner) external;

function getAdjustedAccountValues(Account.Info calldata account)

external

view

returns (Monetary.Value memory, Monetary.Value memory);

function getMarketMarginPremium(uint256 marketId)

external

view

returns (Decimal.D256 memory);

function getMarketInterestRate(uint256 marketId)

external

view

returns (Interest.Rate memory);

}

Création du TU permettant d’appeler notre Smart contract

Créer un fichier test/simple-dydx-flashloan.js et ajouter le contenu suivant:

const BN = require('bn.js');

const { assert } = require('chai');

const IERC20 = artifacts.require('IERC20');

const SimpleDyDxFlashloan = artifacts.require('SimpleDyDxFlashloan');

const SOLO = '0x1E0447b19BB6EcFdAe1e4AE1694b0C3659614e4e';

contract('SimpleDyDxFlashloan', accounts => {

const DAI = '0x6B175474E89094C44Da98b954EedeAC495271d0F';

const DAI_WHALE = '0xC73f6738311E76D45dFED155F39773e68251D251';

const DECIMALS = 6;

const FUND_AMOUNT = new BN(10).pow(new BN(18)).mul(new BN(200))

const BORROW_AMOUNT = new BN(10).pow(new BN(18)).mul(new BN(1000000))

let simpleDyDxFlashloan, token, flashloan_user, user;

beforeEach(async () => {

token = await IERC20.at(DAI);

simpleDyDxFlashloan = await SimpleDyDxFlashloan.new();

flashloan_user = accounts[0]

// await network.provider.request({

// method: "hardhat_impersonateAccount",

// params: [DAI_WHALE],

// });

console.log(`contract address is: ${simpleDyDxFlashloan.address}`)

const whale_balance = await token.balanceOf(DAI_WHALE);

assert(whale_balance.gte(FUND_AMOUNT), 'Whale DAI balance has to be higher than FUND AMOUNT');

await token.transfer(simpleDyDxFlashloan.address, FUND_AMOUNT, { from: DAI_WHALE });

const solo_balance = await token.balanceOf(SOLO);

assert(solo_balance.gte(BORROW_AMOUNT), 'Solo balance has to be higher than BORROW AMOUNT');

console.log(`SOLO balance is: ${solo_balance}`);

});

it('flash loan functionality works correctly', async () => {

const tx = await simpleDyDxFlashloan.initiateFlashloan(token.address, BORROW_AMOUNT, { from: flashloan_user });

user = await simpleDyDxFlashloan.user();

for (const log of tx.logs) {

console.log(log.args.message, log.args.val.toString());

}

assert.equal(user, simpleDyDxFlashloan.address,

'user has to be set correctly to the address of simpleDyDxFlashloan');

})

})

Forker le mainnet Ethereum

Créer un fichier de config truffle-config.js au niveau root de votre repo contenant l’alias vers l’environnement mainnet_fork:

module.exports = {

contracts_directory: "./contracts/simple-dydx-flashloan/",

networks: {

mainnet_fork: {

host: "127.0.0.1", // Localhost (default: none)

port: 8545, // Standard Ethereum port (default: none)

network_id: "999", // Any network (default: none)

gas: 0

},

},

// Set default mocha options here, use special reporters etc.

mocha: {

// timeout: 100000

},

// Configure your compilers

compilers: {

solc: {

version: "0.7.6", // Fetch exact version from solc-bin (default: truffle's version)

},

},

}

Repérer une whale possèdant de l’USDC via https://twitter.com/whale_alert, récupérer son wallet Ethereum via Etherscan et unlocker le dans votre fork Ethereum.

source .env

ganache-cli --fork https://mainnet.infura.io/v3/$TOKEN_INFURA --seed $YOUR_SEED -i --unlock $WHALE_ADDRESS --networkId 999

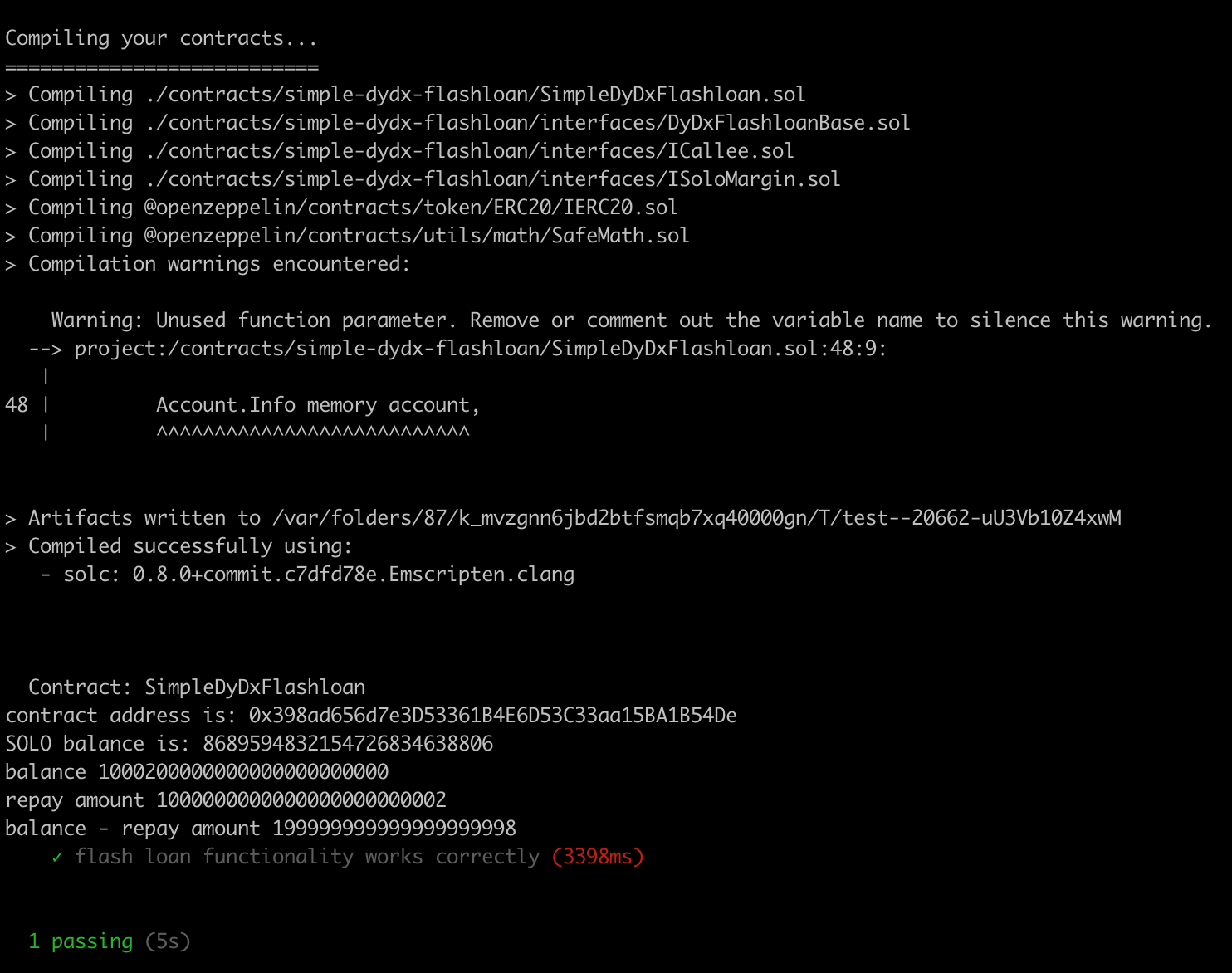

Exécution du swap

npx truffle test --network mainnet_fork test/simple-dydx-flashloan.js

Voilà, si tout est bien configuré, vous devriez voir ceci à la fin du test: